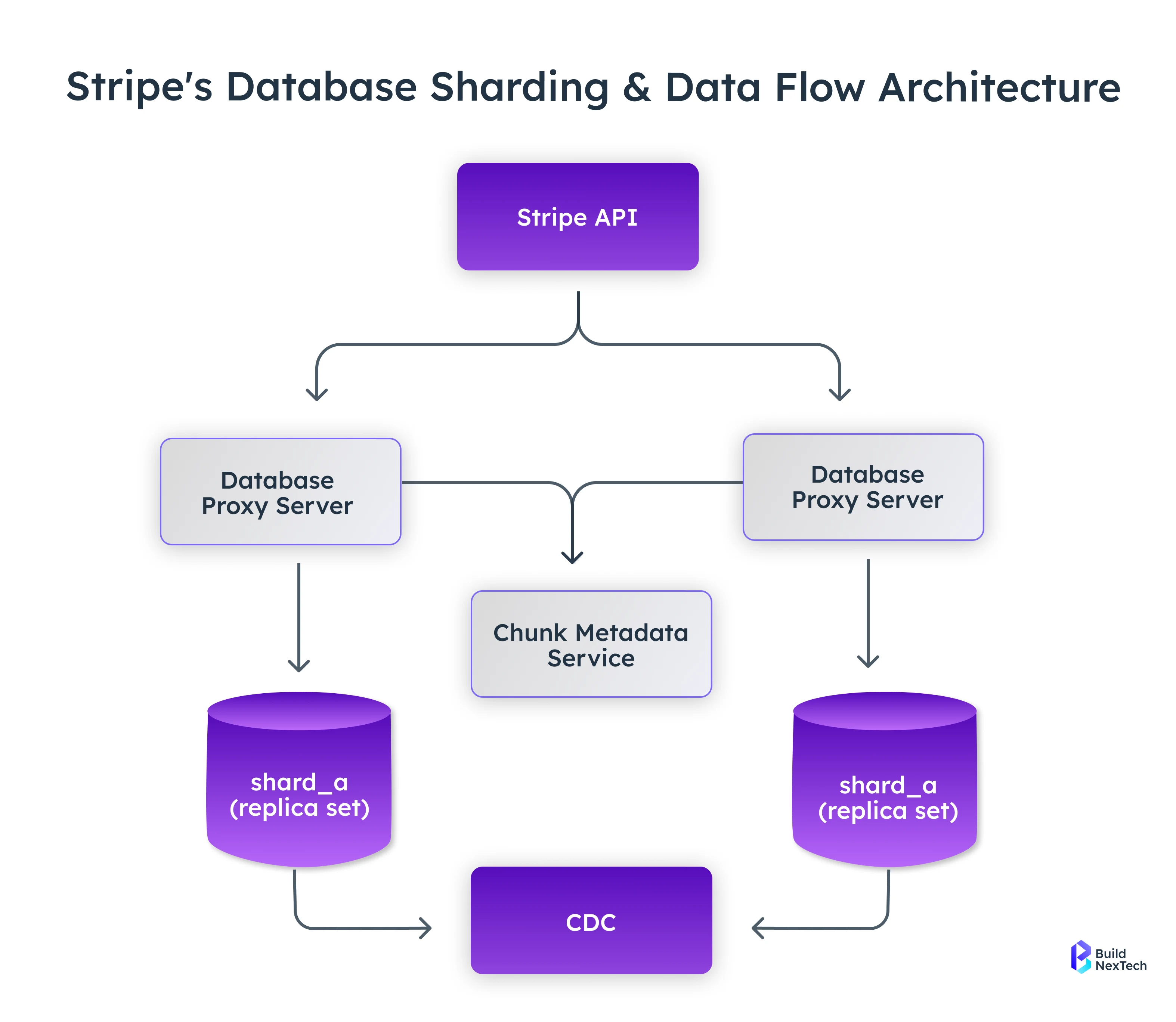

In today’s digital payments ecosystem, every millisecond in a payment flow affects user trust, conversion rates, and business scalability. Companies need fast, secure, and fault-tolerant payment processing systems that operate seamlessly in the background and perform flawlessly under massive global traffic.

At BuildNexTech, we engineer Stripe-level payment infrastructure with low latency, high authorization rates, and enterprise-grade security. From real-time tokenization, encryption, fraud detection, and global scaling, our solutions ensure smooth, secure, and high-performing transactions across every platform through enterprise-grade payment engineering services. Visit BuildNexTech to see how we turn payments into a competitive advantage.

✨ Key Insights from This Article:

💳 How Stripe’s API-first architecture delivers fast, scalable, and developer-friendly payment integration

⚡ Why smart routing and latency optimization significantly boost authorization and checkout speeds

🛡️ How tokenization, AES-256 encryption, and secure key management protect sensitive payment data

🤖 Role of AI-driven fraud detection (Radar) in reducing false declines and chargebacks

🌍 How Stripe’s modular infrastructure and global data centers ensure high reliability under heavy traffic

Introduction: The Growing Demand for Instant and Secure Payments

Within this rapidly evolving digital economy, Stripe has positioned itself as a leading payment gateway engineered for speed, resilience, and secure Stripe payments. Its API first architecture, global-ready infrastructure, and advanced fraud detection give businesses the foundation required to handle real-time settlement at internet scale. This blog looks inside Stripe’s fintech infrastructure to reveal the technologies that power its secure, lightning-fast payments.

The Pace of the Digital Economy: Why Speed and Security Cannot Be Compromised

Massive volumes of online transactions occur every second, creating a high-pressure environment for any payment system:

- Delays or failures instantly reduce revenue.

- Customers expect sub-second checkout optimization and real-time settlement.

- Security must operate silently without affecting payment performance, safeguarding privacy.

- Reliability supports repeat purchases and long-term trust.

To thrive, companies need real-time, secure, and reliable payments that maintain performance even under global demand. Stripe aligns with these expectations, making it a preferred platform for digital-first businesses in e-commerce. This is a necessary Learning curve for any global player.

Stripe’s Value Proposition: Fast, Secure, and Built for Global Scalability

The Stripe company delivers far more than basic payment processing. Its infrastructure supports rapid scaling, advanced risk management, multi-currency global payments, and compliance at a global economy level, making it one of the most reliable Stripe payment gateway platforms worldwide:

- A unified platform for payments, risk, compliance, and reporting

- Deep multi-layered security and privacy

- Developer-friendly APIs that reduce integration time

- Global readiness across currencies, rails, and regulations

Stripe demonstrates how a modern, scalable payments platform should operate.

The Core Engine: Stripe’s API-First Architecture for Unmatched Speed

API-First Architecture for Consistency and Developer Freedom

Stripe’s API-first architecture - powered by the Stripe developer API - ensures consistent behavior across services and gives developers granular control over complex payment flows:

- Predictable endpoints ensure reliable performance under load

- Clear API documentation reduces integration errors

- High flexibility suits FinTech Operations, SaaS, marketplaces, and DeFi applications.

This stable, API-driven foundation empowers developers to build fast and secure payment experiences.

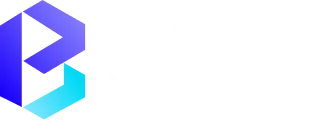

Modular Infrastructure for Global Scalability

Stripe uses modular, globally distributed components rather than a monolithic system:

- Global data centers reduce latency

- Sharded services minimize failure impact

- Independent scaling supports peak demand events

This ensures dependable payment reliability for businesses of all sizes.

Engineering for Lightning-Fast Processing: Optimizing Every Millisecond

Smart Routing for Faster Authorization

Stripe’s smart routing capability - a core feature of the Stripe payment service - uses machine learning to evaluate banks' performance in real time:

- Automatically selects the fastest authorization routing, reducing reliance on slow legacy systems like SWIFT.

- Improves authorization rates

- Reduces delays introduced by external networks

This dynamic routing is key to Stripe’s Faster Payments performance.

Latency Reduction at Every Layer

Stripe’s infrastructure is built to minimize processing delays at every stage of a transaction, ensuring payments move across global networks with near-instant response times. By intelligently routing traffic and placing compute resources strategically, Stripe enables lightning-fast checkouts that enhance the digital customer experience.

- Processing nodes near financial hubs

- Regional routing to avoid unnecessary network distance

- Edge networks to accelerate authorization

These optimizations ensure instant, seamless checkouts, improving the digital experience - all built on the robustness of the Stripe API.

Resilience Through Intelligent Retries and Failover

The payment system of Stripe keeps Stripe online payments resilient to temporary outages, banking delays, or network issues without interruptions to the customer experience. Stripe gracefully retries failed payments and reroutes traffic to the next gateway, without any time-out or notice to the customer. Stripe consistently processes recurring and high traffic payments without incident.

- Predictive retries recover soft declines

- Exponential backoff protects system stability

- Automatic failover reroutes traffic instantly

This enhances recurring payments, high-volume transactions, and payment reliability.

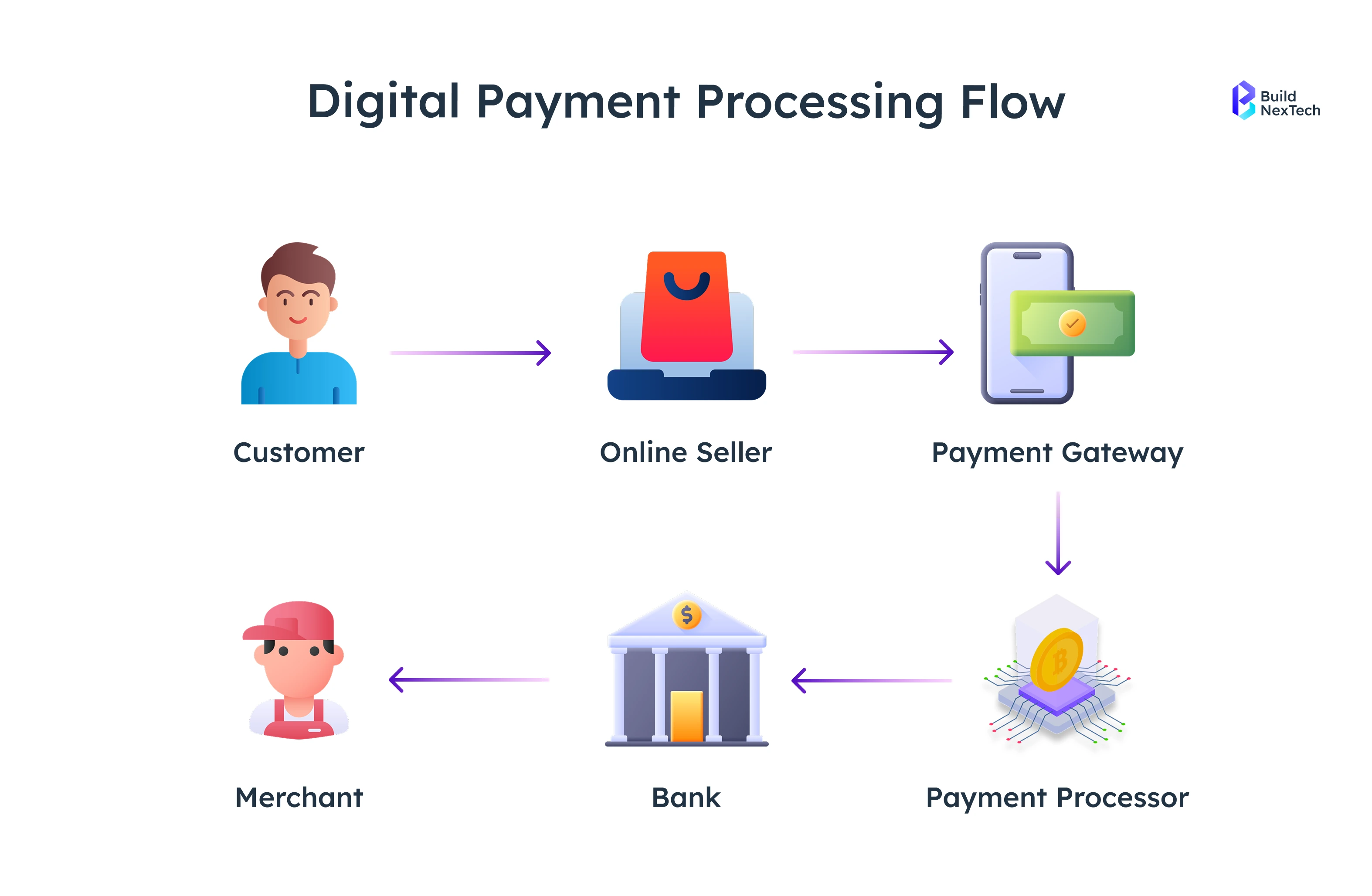

The Unshakeable Fortress: Stripe’s Multi-Layered Security Paradigm

Tokenization and Encryption for Sensitive Data Protection

The Stripe payment system immediately substitutes sensitive card data with secure tokens, providing end-to-end protection. Featuring strong encryption, tokenization, and separate key management, it mitigates the merchant compliance burden and supports safe and seamless payments for the customer.

- End-to-end tokenization: Secure tokens instantly replace card details so that sensitive data never comes into contact with your systems.

- AES-256 encryption to protect card data and maintain privacy: Advanced encryption protects payment information at all points of the transaction.

- Dedicated key management to avoid single points of failure: Encryption keys are stored and managed separately to lower risk and improve security.

- Reduces merchant compliance burden: By handling tokenization and encryption, Stripe reduces PCI compliance requirements for businesses.

This structure reduces merchant compliance burdens and increases secure payments.

AI-Driven Fraud Detection with Radar

Stripe Radar uses advanced machine learning and large datasets to protect businesses from fraud in real-time. It combines predictive models, device fingerprinting, and adaptive risk scoring to protect businesses from fraudulent acts globally while limiting false positives and smoothing customer experience.

- Machine learning fraud detection models

- Device fingerprinting and adaptive risk scoring

- Automatic blocking with fewer false positives against fraudsters.

Radar serves as a global fraud detection shield without hurting conversions. This also helps mitigate costly chargebacks and reduces the need for manual risk management.

Compliance at Scale

Stripe emphasizes compliance with regulations and customer data security so that businesses can have confidence when relying on a globally audited Stripe payment processor. The systems have been designed with the focus of delivering the highest industry satisfaction, protecting customer data, and providing audit-ready controls for enhanced risk management. Important compliance features include the following;

- PCI-DSS Level 1 certified secure card processing

- Privacy protections for GDPR aligned global data storage

- Audit-ready controls for efficient regulatory reporting

- Intrinsically built-in safety features to lower internal risk management

Built-in safeguards that reduce internal risk management. Businesses can operate globally with confidence.

Stripe in the Modern Payment Landscape: Adapting to the Future of Speed

Real-Time Payments & A2A Innovation

Stripe is progressing its payment capabilities to enable instant settlement and account-to-account (A2A) payments. Newer payment rails and open banking solutions enable Stripe to offer faster, cheaper transfers while placing businesses at the center of the real-time settlement revolution.

- Pay by Bank and open banking payments offer alternative flows that leverage Liquidity providers.

- RTP rails for near-instant transfers (Faster Payments)

- Lower-cost bank-to-bank flows

This positions Stripe at the forefront of the real-time settlement revolution, connecting directly with banks.

The Lightning Edge (Future-Ready Settlement)

Stripe is constantly innovating its payment infrastructure to conduct high-volume, real-time transactions. Its API-first architecture with security and optimized settlement help businesses grow with confidence while providing seamless and dependable payment experiences for customers worldwide.

Unified Commerce for Omnichannel Experiences

Stripe assists organizations in developing a smooth payment experience in online, mobile, and in-store scenarios - positioning itself as a unified Stripe payment platform. Stripe integrates payment processing and customer identity, enabling businesses to gain insights in real time, boost retention, and streamline all omnichannel operations.

- Stripe Terminal for physical payments

- Shared payment and customer experience identity across channels

- Real-time insights that improve retention

This unified model simplifies omnichannel payment processing.

The Business Impact: How Stripe Drives Growth Through Speed and Security

Enhanced Customer Experience Through Instant Checkouts

Stripe’s optimization centers on improving the total checkout experience and Stripe payment processing to deliver stronger business results. Making transactions quicker and more reliable, it allows businesses to reduce friction, build customer trust, and create better experiences, even under high traffic volume.

- Faster, more secure checkouts, improving customer experience

- Lower cart abandonment

- Higher trust during peak traffic

Real-time settlement API performance directly improves CX.

The Value Proposition of Payment Reliability: From Failed Payments to Revenue Capture

Trustworthy payment processing is essential for gaining the most from revenue and disrupting operations as little as possible. The intelligence underlying Stripe helps businesses recover lost transactions, prevent false declines, and optimize authorizations, all with a measurable revenue impact.

- Predictive retries recover lost revenue

- Fewer false declines

- Improved authorization across global networks via smart routing to banks

Businesses see measurable increases in revenue capture.

Developer Efficiency and Lower Operational Costs

Stripe's approach of being developer-first enables organizations to save time and resources by allowing them to spend less time debugging and maintaining their products. The API design allows organizations to release products faster and reduce costs over the long run, and strengthens Stripe as FinTech operations platform.

- Reduces debugging and maintenance time

- Speeds up product launches through great API design

- Lowers long-term operational costs

This reinforces Stripe as a powerful FinTech Operations platform.

Conclusion: Stripe’s Enduring Vision for Fast, Secure Payments

Thanks to unmatched speed, multilayered security, API-first architecture, and readiness to real-time settlements, Stripe has become the global standard for internet payments. From innovations in Faster Payments and open banking solutions to future-ready settlement layers (such as potential Lightning Network integration), Stripe is at the forefront of the evolution of global payment processing. Stripe's infrastructure enables businesses of any size to reliably manage complex transactions, while innovating to keep pace with a rapidly changing digital economy.

BuildNexTech enables businesses to fully engage in Stripe’s payments architecture and build robust, scalable, secure, and performant payment systems. With our experience, enterprises are enabled to scale confidently, optimize operations, and continuously deliver seamless payment experiences at the pace of modern digital commerce.

People Also Ask

Does Stripe offer point-of-sale hardware for in-person payments?

Yes, Stripe provides card readers and POS hardware for in-person transactions. This makes it easy for businesses to accept payments at retail locations.

Can Stripe be integrated with popular eCommerce platforms like Shopify or WooCommerce?

Stripe seamlessly integrates with platforms like Shopify and WooCommerce. This allows online stores to process payments without extra setup.

What currencies does Stripe support for international payments?

Stripe supports over 135 currencies globally. Businesses can accept payments from customers around the world easily.

Does Stripe provide chargeback protection or dispute management tools?

Stripe includes dispute management and chargeback handling tools. This helps businesses manage payment issues efficiently.

.webp)

.webp)

.webp)